Current liabilities embody money owed such as accounts payable, worker wages and taxes. Similar to present belongings, current liabilities are all of the funds that your organization should make within a yr of the balance sheet date. The double entry accounting principle ensures that the entries in your company’s financial statements are consistent. It will present what your organization owns as belongings and owes as liabilities. While a balance sheet doesn’t present insights into longer monetary developments, it shows you the general financial condition for a selected cut-off date.

The balance sheet is often ready at the finish of an accounting period. It is an integral part of the company’s monetary statements package deal. Alongside the income statement and cash flow statement, it provides a complete view of the company’s financial efficiency.

Spend Money On Zero-debt Firms With Smallcase

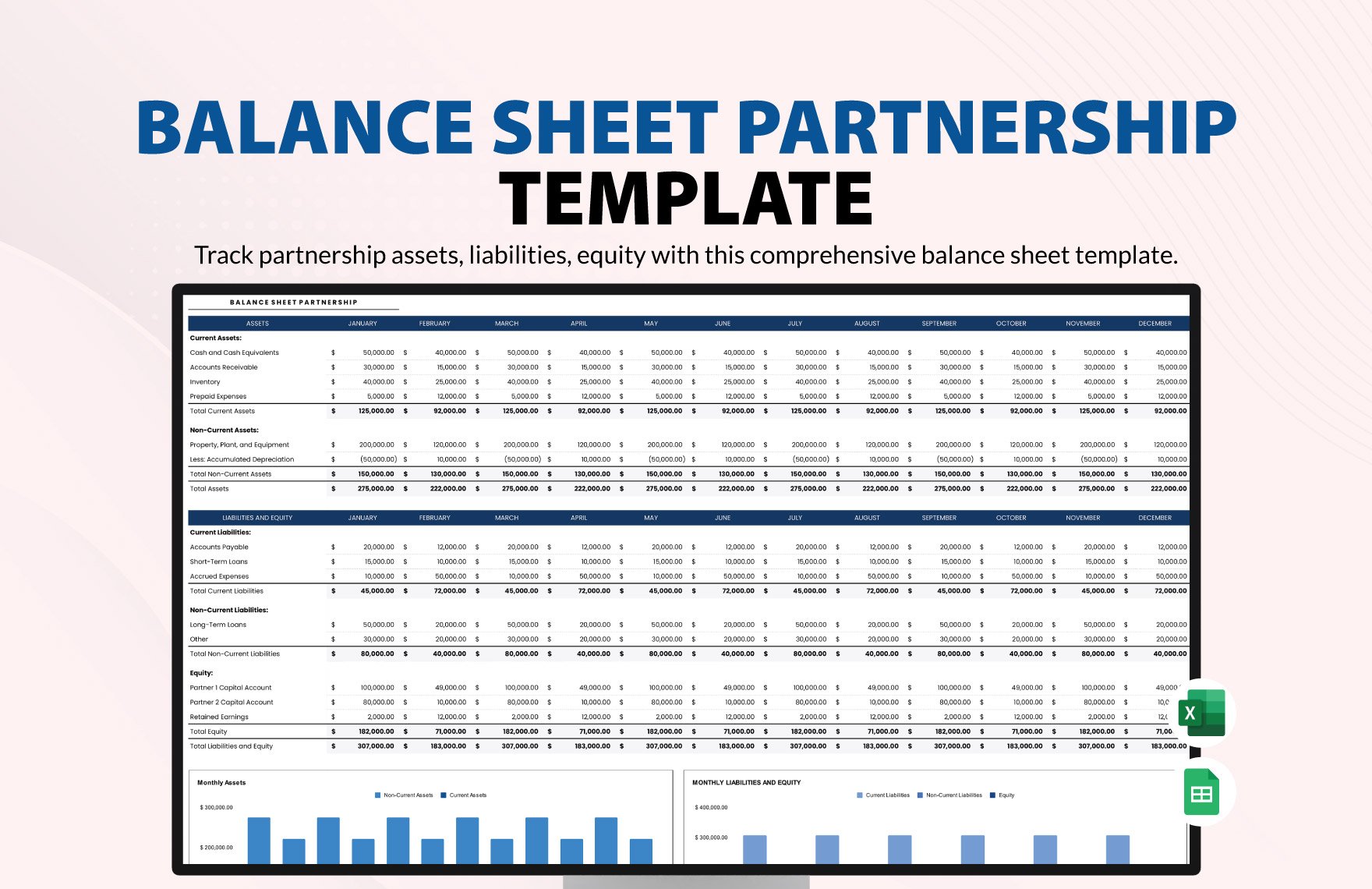

At Present, we’ll go over what a balance sheet is and tips on how to master it to keep accurate financial records. The picture under is an example of a comparative steadiness sheet of Apple, Inc. This stability sheet compares its financial place as of September 2024 to that of the previous 12 months. Totally Different accounting systems and methods of dealing with depreciation and inventories will also change the figures posted to a balance sheet. Because of this, managers have some ability to game the numbers to make them look extra favorable.

- Stakeholders should interpret balance sheet data inside the broader financial context.

- Many financial ratios draw on knowledge included in both the steadiness sheet, income statement, and assertion of cash flows to paint a fuller image of what is going on on with a company’s business.

- A steadiness sheet is a key financial tool for enterprise house owners, executives, analysts and anybody who needs a clear image of an organization’s present monetary place.

- Comparing several years of a company’s balance sheet might spotlight developments, for higher or worse.

- The earnings statement exhibits a company’s revenues, bills and profitability over a selected interval, often a month, a quarter or a 12 months.

Long-term liabilities are obligations that do not require the usage of current assets or the creation of current liabilities. Some examples of such liabilities include long-term debts, bonds, and so on. Steadiness sheets define a company’s funds for managers, buyers, and regulators. In The End, what a stability sheet is matters lower than what it could do. By weighing property against liabilities, reading steadiness sheets paints an image of enterprise performance.

B Evaluating Investment Opportunities

The auditors must conduct a full audit of the balance sheet at year-end, earlier than the year-end balance sheet could be released. This is the total quantity of internet income the corporate decides to maintain. Every interval, an organization may pay out dividends from its net revenue. Any quantity remaining (or exceeding) is added to (deducted from) retained earnings. Accounts Payables, or AP, is the amount an organization owes suppliers for items or providers bought on credit.

Belongings, liabilities, and fairness are fundamental components of the balance sheet. Non-current belongings embrace property, plant, and gear, and intangible assets. Master the fundamentals of financial accounting with our Accounting for Monetary Analysts Course. This complete program offers over 16 hours of expert-led video tutorials, guiding you through the preparation and analysis of income statements, balance sheets, and money move statements.

An investor can use a stability sheet to help determine the company’s short- and long-term monetary health. Traders can even compare a company’s current stability sheet and related monetary ratios to its past stability sheets and/or to the ratios of different companies. Each stability sheet will present the most recent info on belongings, liabilities, and shareholder fairness as of the reporting date. It will typically additionally provide the identical info for a earlier reporting date, such as the quarter or year before.

It’s necessary to maintain correct steadiness sheets often for that reason. A legal responsibility is any cash that an organization owes to outside events, from payments it has to pay to suppliers to interest on bonds issued to creditors to hire, utilities, and salaries. Current liabilities are due inside one year and are listed so as of their due date. Long-term liabilities, on the opposite hand, are due at any level after one year. In double-entry bookkeeping, every account has its personal journal – that features https://www.simple-accounting.org/ asset, liability, and equity accounts, nevertheless it additionally contains expense and earnings accounts. Each time you report a transaction, you make two entries – a double entry’.

Stock consists of quantities for raw supplies, work-in-progress items, and finished items. The company uses this account when it reports sales of products, generally beneath cost of goods sold within the income assertion. When traders ask for a stability sheet, they need to make sure it’s correct to the current time interval.

For example, the asset turnover ratio exhibits the efficiency of asset usage by dividing common total property by net gross sales. Equally, internet working capital may be compared to gross sales to estimate the effectivity of working capital usage. Modifications in steadiness sheet accounts are also used to calculate money move within the money move statement. For instance, a positive change in plant, property, and gear is equal to capital expenditure minus depreciation expense. If depreciation expense is thought, capital expenditure could be calculated and included as a money outflow beneath cash move from investing within the money move assertion.

Comments are closed